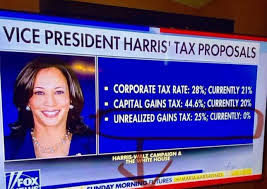

What Will Be The Affects of Taxing Unrealized Capital Gains?

Taxing unrealized capital gains would have several significant and complex effects on both individuals and the broader economy. Here's a breakdown of some key impacts:

1. Impact on Investors and Asset Holders:

Increased Tax Burden: Individuals and corporations with significant holdings in assets like stocks, real estate, and art would face an increased tax burden, as they would be taxed on the market value appreciation of their assets even if they haven't sold them.

Liquidity Issues: Many people might face liquidity issues, especially if they hold non-liquid assets (e.g., real estate, private company shares). They would owe taxes on gains without selling the asset, potentially forcing them to sell part of their holdings to meet tax obligations.

Behavioral Shifts: Investors might change their strategies to minimize exposure to taxes on unrealized gains, such as shifting towards assets that are more difficult to value, holding onto assets longer, or investing in tax-sheltered accounts.

OWN SILVER

2. Market Impacts:

Increased Volatility: If investors are forced to sell assets to meet tax liabilities, there could be greater market volatility, especially in asset classes like stocks or real estate.

Reduced Investment Incentives: Taxing unrealized gains could reduce incentives to invest, especially in high-risk ventures or long-term investments, as people would need to pay taxes regardless of whether they realize a gain through sale.

Impact on Market Prices: Forced sales due to liquidity concerns could lead to downward pressure on asset prices, as more sellers may flood the market.

3. Impact on Economic Growth:

Entrepreneurship and Innovation: This policy could discourage entrepreneurship and investment in startups or innovative projects, as investors may be more cautious about investing in ventures that take time to yield returns.

Productivity and Capital Formation: If investors shy away from long-term investments due to the tax, it could slow capital formation, which is critical for productivity growth and overall economic development.

4. Revenue for Governments:

Increased Revenue: Governments would generate more immediate revenue by taxing unrealized gains, especially from high-net-worth individuals who often defer taxes by holding onto appreciated assets.

Administrative Complexity: Implementing such a tax would require substantial administrative infrastructure, including regular asset valuations, which can be complex, especially for illiquid or hard-to-value assets like privately held companies or art collections.

5. Wealth Distribution:

Impact on Wealth Inequality: Proponents argue that taxing unrealized capital gains could help address wealth inequality, as the wealthy often derive much of their income from capital appreciation rather than wages. This could level the playing field by ensuring they pay taxes on their wealth accumulation.

Possible Exemptions: There may be political or social pressure to exempt certain assets, such as family homes or small businesses, which could limit the overall impact on wealth redistribution.

6. International Considerations:

Capital Flight: High-net-worth individuals might move their assets or themselves to countries with more favorable tax policies, leading to capital flight and potential losses in domestic investment.

Global Coordination: If only one country implements a tax on unrealized capital gains, there could be competitive disadvantages for businesses and investors in that country unless global coordination or tax treaties are in place.

7. Legal and Constitutional Challenges:

Constitutional Issues: In some countries, taxing unrealized gains may face constitutional challenges, particularly in systems where taxes on income or wealth are traditionally based on realized events like sales or income received.

Conclusion:

While taxing unrealized capital gains could generate significant revenue and potentially address wealth inequality, it would also present challenges, such as liquidity issues, potential market volatility, reduced investment incentives, and administrative complexity. The effects would depend on the specifics of the policy, including exemptions, rates, and valuation mechanisms.

How Can Investors and Property Owners Avoid Taxes On Unrealized Gains?

What Will Be The Affects of Taxing Unrealized Capital Gains?

Taxing unrealized capital gains would have several significant and complex effects on both individuals and the broader economy. Here's a breakdown of some key impacts:

1. Impact on Investors and Asset Holders:

Increased Tax Burden: Individuals and corporations with significant holdings in assets like stocks, real estate, and art would face an increased tax burden, as they would be taxed on the market value appreciation of their assets even if they haven't sold them.

Liquidity Issues: Many people might face liquidity issues, especially if they hold non-liquid assets (e.g., real estate, private company shares). They would owe taxes on gains without selling the asset, potentially forcing them to sell part of their holdings to meet tax obligations.

Behavioral Shifts: Investors might change their strategies to minimize exposure to taxes on unrealized gains, such as shifting towards assets that are more difficult to value, holding onto assets longer, or investing in tax-sheltered accounts.

2. Market Impacts:

Increased Volatility: If investors are forced to sell assets to meet tax liabilities, there could be greater market volatility, especially in asset classes like stocks or real estate.

Reduced Investment Incentives: Taxing unrealized gains could reduce incentives to invest, especially in high-risk ventures or long-term investments, as people would need to pay taxes regardless of whether they realize a gain through sale.

Impact on Market Prices: Forced sales due to liquidity concerns could lead to downward pressure on asset prices, as more sellers may flood the market.

3. Impact on Economic Growth:

Entrepreneurship and Innovation: This policy could discourage entrepreneurship and investment in startups or innovative projects, as investors may be more cautious about investing in ventures that take time to yield returns.

Productivity and Capital Formation: If investors shy away from long-term investments due to the tax, it could slow capital formation, which is critical for productivity growth and overall economic development.

4. Revenue for Governments:

Increased Revenue: Governments would generate more immediate revenue by taxing unrealized gains, especially from high-net-worth individuals who often defer taxes by holding onto appreciated assets.

Administrative Complexity: Implementing such a tax would require substantial administrative infrastructure, including regular asset valuations, which can be complex, especially for illiquid or hard-to-value assets like privately held companies or art collections.

5. Wealth Distribution:

Impact on Wealth Inequality: Proponents argue that taxing unrealized capital gains could help address wealth inequality, as the wealthy often derive much of their income from capital appreciation rather than wages. This could level the playing field by ensuring they pay taxes on their wealth accumulation.

Possible Exemptions: There may be political or social pressure to exempt certain assets, such as family homes or small businesses, which could limit the overall impact on wealth redistribution.

6. International Considerations:

Capital Flight: High-net-worth individuals might move their assets or themselves to countries with more favorable tax policies, leading to capital flight and potential losses in domestic investment.

Global Coordination: If only one country implements a tax on unrealized capital gains, there could be competitive disadvantages for businesses and investors in that country unless global coordination or tax treaties are in place.

7. Legal and Constitutional Challenges:

Constitutional Issues: In some countries, taxing unrealized gains may face constitutional challenges, particularly in systems where taxes on income or wealth are traditionally based on realized events like sales or income received.

Conclusion:

While taxing unrealized capital gains could generate significant revenue and potentially address wealth inequality, it would also present challenges, such as liquidity issues, potential market volatility, reduced investment incentives, and administrative complexity. The effects would depend on the specifics of the policy, including exemptions, rates, and valuation mechanisms.

How Can Investors and Property Owners Avoid Taxes On Unrealized Gains?

Avoiding taxes on unrealized capital gains requires careful tax planning, as well as using legal strategies to minimize or defer tax liabilities. Here are several common approaches investors and property owners use:

1. Hold Assets for Long Periods (Deferral Strategy):

Deferring Realization: Since taxes on capital gains are typically only triggered when an asset is sold (realized), one straightforward way to avoid taxes on unrealized gains is simply to hold onto assets for longer periods. As long as the asset is not sold, no tax is owed on the appreciation.

Step-Up in Basis at Death: In many countries, heirs can inherit property with a "stepped-up basis," which means the asset’s value is adjusted to the current market value at the time of inheritance. This eliminates capital gains taxes on the appreciation that occurred during the original owner’s lifetime, making it a popular strategy for high-net-worth individuals.

2. Use of Tax-Deferred Accounts:

Retirement Accounts (IRAs, 401(k)s, etc.): Investors can hold assets in tax-deferred accounts such as IRAs or 401(k)s. Gains on investments within these accounts are not taxed until withdrawals are made in retirement, allowing for tax-free compounding of returns in the interim.

Roth IRAs: In Roth IRAs, contributions are made with after-tax dollars, but withdrawals, including on gains, are tax-free if certain conditions are met. This can avoid taxes on unrealized gains altogether, provided the assets are held long enough.

3. Tax-Loss Harvesting:

Offset Gains with Losses: Investors can sell losing assets to offset capital gains on winning investments. This "tax-loss harvesting" strategy can reduce the overall tax burden by using realized losses to negate realized gains.

Carry Forward Losses: If losses exceed gains in a given tax year, the excess loss can often be carried forward to future years to offset future gains.

4. Opportunity Zone Investments:

Deferral through Opportunity Zones: In the U.S., the Opportunity Zone program allows investors to defer taxes on capital gains if they reinvest the proceeds in qualifying Opportunity Zone projects. The deferral lasts until 2026, and depending on the length of time the investment is held, part of the gain can be excluded altogether.

5. 1031 Exchange (Real Estate-Specific):

Real Estate Investors: A 1031 exchange allows property owners to defer capital gains taxes on the sale of an investment property if the proceeds are reinvested into a "like-kind" property (typically another real estate asset). This strategy can be used repeatedly to defer taxes indefinitely, allowing investors to continue to build wealth without triggering a tax event.

6. Gifting or Charitable Contributions:

Charitable Remainder Trust (CRT): Investors can transfer appreciated assets into a CRT, which pays an income stream to the donor or beneficiaries for a specified period. After that, the remaining assets go to a charity. This allows for deferral of capital gains taxes and provides a tax deduction based on the present value of the remainder gift.

Donating Appreciated Assets: Instead of selling an asset and paying capital gains taxes, investors can donate appreciated stocks, real estate, or other assets directly to a charity. They can receive a charitable tax deduction for the fair market value of the asset while avoiding the capital gains tax.

7. Use of Insurance Products:

Life Insurance and Annuities: Certain insurance products like whole life insurance and annuities allow investors to defer taxes on investment gains until withdrawals are made. Gains within these products accumulate tax-free, and depending on the product, payouts can be structured in tax-advantaged ways.

8. Moving to Low or No-Tax Jurisdictions:

Relocation: Some high-net-worth individuals may choose to move to countries or states that have lower or no capital gains taxes. For example, in the U.S., states like Florida, Texas, and Nevada have no state capital gains taxes, while some countries offer favorable tax treatment or don't tax capital gains at all.

Expatriation: In extreme cases, individuals renounce their citizenship in high-tax countries to become residents or citizens of countries with more favorable tax treatment. However, this is typically subject to exit taxes, such as the U.S. expatriation tax.

9. Borrowing Against Assets (Loan Strategies):

Using Assets as Collateral: Investors can avoid selling appreciated assets and triggering taxes by borrowing against them instead. By taking out loans secured by appreciated stocks or real estate, investors can access liquidity without triggering a taxable event. Interest on such loans is often tax-deductible, adding to the benefits of this strategy.

10. Estate and Wealth Planning Structures:

Family Trusts: Trust structures such as Grantor Retained Annuity Trusts (GRATs) or Intentionally Defective Grantor Trusts (IDGTs) can allow individuals to transfer wealth to beneficiaries in a tax-efficient manner. These structures can help minimize or defer capital gains and estate taxes.

Foundations and Donor-Advised Funds: Wealthy investors often set up private foundations or donor-advised funds to hold appreciated assets. This strategy provides a charitable deduction and allows tax-free growth of the assets within the foundation or fund.

11. Monitoring Tax Law Changes:

Staying Informed: Tax laws are subject to change, and new regulations could create or close opportunities to avoid taxes on unrealized gains. Investors should work with tax advisors to stay up to date on the latest legal strategies.

Conclusion:

Most strategies for avoiding or minimizing taxes on unrealized capital gains revolve around deferring the realization of gains, leveraging tax-deferred accounts, or taking advantage of specific tax breaks and exemptions. It's important to work with financial advisors and tax professionals to ensure compliance with the law and optimize tax efficiency.

Is It Currently LEGAL To Tax Unrealized Capital Gains?

What Will Be The Affects of Taxing Unrealized Capital Gains?

Taxing unrealized capital gains would have several significant and complex effects on both individuals and the broader economy. Here's a breakdown of some key impacts:

1. Impact on Investors and Asset Holders:

Increased Tax Burden: Individuals and corporations with significant holdings in assets like stocks, real estate, and art would face an increased tax burden, as they would be taxed on the market value appreciation of their assets even if they haven't sold them.

Liquidity Issues: Many people might face liquidity issues, especially if they hold non-liquid assets (e.g., real estate, private company shares). They would owe taxes on gains without selling the asset, potentially forcing them to sell part of their holdings to meet tax obligations.

Behavioral Shifts: Investors might change their strategies to minimize exposure to taxes on unrealized gains, such as shifting towards assets that are more difficult to value, holding onto assets longer, or investing in tax-sheltered accounts.

2. Market Impacts:

Increased Volatility: If investors are forced to sell assets to meet tax liabilities, there could be greater market volatility, especially in asset classes like stocks or real estate.

Reduced Investment Incentives: Taxing unrealized gains could reduce incentives to invest, especially in high-risk ventures or long-term investments, as people would need to pay taxes regardless of whether they realize a gain through sale.

Impact on Market Prices: Forced sales due to liquidity concerns could lead to downward pressure on asset prices, as more sellers may flood the market.

3. Impact on Economic Growth:

Entrepreneurship and Innovation: This policy could discourage entrepreneurship and investment in startups or innovative projects, as investors may be more cautious about investing in ventures that take time to yield returns.

Productivity and Capital Formation: If investors shy away from long-term investments due to the tax, it could slow capital formation, which is critical for productivity growth and overall economic development.

4. Revenue for Governments:

Increased Revenue: Governments would generate more immediate revenue by taxing unrealized gains, especially from high-net-worth individuals who often defer taxes by holding onto appreciated assets.

Administrative Complexity: Implementing such a tax would require substantial administrative infrastructure, including regular asset valuations, which can be complex, especially for illiquid or hard-to-value assets like privately held companies or art collections.

5. Wealth Distribution:

Impact on Wealth Inequality: Proponents argue that taxing unrealized capital gains could help address wealth inequality, as the wealthy often derive much of their income from capital appreciation rather than wages. This could level the playing field by ensuring they pay taxes on their wealth accumulation.

Possible Exemptions: There may be political or social pressure to exempt certain assets, such as family homes or small businesses, which could limit the overall impact on wealth redistribution.

6. International Considerations:

Capital Flight: High-net-worth individuals might move their assets or themselves to countries with more favorable tax policies, leading to capital flight and potential losses in domestic investment.

Global Coordination: If only one country implements a tax on unrealized capital gains, there could be competitive disadvantages for businesses and investors in that country unless global coordination or tax treaties are in place.

7. Legal and Constitutional Challenges:

Constitutional Issues: In some countries, taxing unrealized gains may face constitutional challenges, particularly in systems where taxes on income or wealth are traditionally based on realized events like sales or income received.

Conclusion:

While taxing unrealized capital gains could generate significant revenue and potentially address wealth inequality, it would also present challenges, such as liquidity issues, potential market volatility, reduced investment incentives, and administrative complexity. The effects would depend on the specifics of the policy, including exemptions, rates, and valuation mechanisms.

How Can Investors and Property Owners Avoid Taxes On Unrealized Gains?

Avoiding taxes on unrealized capital gains requires careful tax planning, as well as using legal strategies to minimize or defer tax liabilities. Here are several common approaches investors and property owners use:

1. Hold Assets for Long Periods (Deferral Strategy):

Deferring Realization: Since taxes on capital gains are typically only triggered when an asset is sold (realized), one straightforward way to avoid taxes on unrealized gains is simply to hold onto assets for longer periods. As long as the asset is not sold, no tax is owed on the appreciation.

Step-Up in Basis at Death: In many countries, heirs can inherit property with a "stepped-up basis," which means the asset’s value is adjusted to the current market value at the time of inheritance. This eliminates capital gains taxes on the appreciation that occurred during the original owner’s lifetime, making it a popular strategy for high-net-worth individuals.

2. Use of Tax-Deferred Accounts:

Retirement Accounts (IRAs, 401(k)s, etc.): Investors can hold assets in tax-deferred accounts such as IRAs or 401(k)s. Gains on investments within these accounts are not taxed until withdrawals are made in retirement, allowing for tax-free compounding of returns in the interim.

Roth IRAs: In Roth IRAs, contributions are made with after-tax dollars, but withdrawals, including on gains, are tax-free if certain conditions are met. This can avoid taxes on unrealized gains altogether, provided the assets are held long enough.

3. Tax-Loss Harvesting:

Offset Gains with Losses: Investors can sell losing assets to offset capital gains on winning investments. This "tax-loss harvesting" strategy can reduce the overall tax burden by using realized losses to negate realized gains.

Carry Forward Losses: If losses exceed gains in a given tax year, the excess loss can often be carried forward to future years to offset future gains.

4. Opportunity Zone Investments:

Deferral through Opportunity Zones: In the U.S., the Opportunity Zone program allows investors to defer taxes on capital gains if they reinvest the proceeds in qualifying Opportunity Zone projects. The deferral lasts until 2026, and depending on the length of time the investment is held, part of the gain can be excluded altogether.

5. 1031 Exchange (Real Estate-Specific):

Real Estate Investors: A 1031 exchange allows property owners to defer capital gains taxes on the sale of an investment property if the proceeds are reinvested into a "like-kind" property (typically another real estate asset). This strategy can be used repeatedly to defer taxes indefinitely, allowing investors to continue to build wealth without triggering a tax event.

6. Gifting or Charitable Contributions:

Charitable Remainder Trust (CRT): Investors can transfer appreciated assets into a CRT, which pays an income stream to the donor or beneficiaries for a specified period. After that, the remaining assets go to a charity. This allows for deferral of capital gains taxes and provides a tax deduction based on the present value of the remainder gift.

Donating Appreciated Assets: Instead of selling an asset and paying capital gains taxes, investors can donate appreciated stocks, real estate, or other assets directly to a charity. They can receive a charitable tax deduction for the fair market value of the asset while avoiding the capital gains tax.

7. Use of Insurance Products:

Life Insurance and Annuities: Certain insurance products like whole life insurance and annuities allow investors to defer taxes on investment gains until withdrawals are made. Gains within these products accumulate tax-free, and depending on the product, payouts can be structured in tax-advantaged ways.

8. Moving to Low or No-Tax Jurisdictions:

Relocation: Some high-net-worth individuals may choose to move to countries or states that have lower or no capital gains taxes. For example, in the U.S., states like Florida, Texas, and Nevada have no state capital gains taxes, while some countries offer favorable tax treatment or don't tax capital gains at all.

Expatriation: In extreme cases, individuals renounce their citizenship in high-tax countries to become residents or citizens of countries with more favorable tax treatment. However, this is typically subject to exit taxes, such as the U.S. expatriation tax.

9. Borrowing Against Assets (Loan Strategies):

Using Assets as Collateral: Investors can avoid selling appreciated assets and triggering taxes by borrowing against them instead. By taking out loans secured by appreciated stocks or real estate, investors can access liquidity without triggering a taxable event. Interest on such loans is often tax-deductible, adding to the benefits of this strategy.

10. Estate and Wealth Planning Structures:

Family Trusts: Trust structures such as Grantor Retained Annuity Trusts (GRATs) or Intentionally Defective Grantor Trusts (IDGTs) can allow individuals to transfer wealth to beneficiaries in a tax-efficient manner. These structures can help minimize or defer capital gains and estate taxes.

Foundations and Donor-Advised Funds: Wealthy investors often set up private foundations or donor-advised funds to hold appreciated assets. This strategy provides a charitable deduction and allows tax-free growth of the assets within the foundation or fund.

11. Monitoring Tax Law Changes:

Staying Informed: Tax laws are subject to change, and new regulations could create or close opportunities to avoid taxes on unrealized gains. Investors should work with tax advisors to stay up to date on the latest legal strategies.

Conclusion:

Most strategies for avoiding or minimizing taxes on unrealized capital gains revolve around deferring the realization of gains, leveraging tax-deferred accounts, or taking advantage of specific tax breaks and exemptions. It's important to work with financial advisors and tax professionals to ensure compliance with the law and optimize tax efficiency.

Is It Currently LEGAL To Tax Unrealized Capital Gains?

The legality of taxing unrealized capital gains depends on the specific legal and constitutional framework of each country. In the United States and many other countries, capital gains taxes are generally applied only to realized gains—those that occur when an asset is sold or transferred. Taxing unrealized capital gains (gains that exist only "on paper" due to an asset’s appreciation without a sale) has not been widely implemented, but the legality of such a tax remains a topic of debate. Here’s an overview of its legal status:

1. United States:

Current Practice: In the U.S., unrealized gains are not taxed under the current tax system. The Internal Revenue Code (IRC) taxes capital gains only when they are realized, meaning when an asset is sold or transferred.

Constitutional Concerns:

The U.S. Constitution provides certain protections that complicate the taxation of unrealized gains, particularly under the 16th Amendment, which gives Congress the power to tax income. Historically, income has been interpreted as profits that are "realized," meaning a sale or exchange of property must occur before a tax is applied.

Some legal scholars argue that taxing unrealized gains would violate this interpretation of the 16th Amendment, as unrealized gains do not represent actual income in the traditional sense.

Proposals and Legal Uncertainty: There have been proposals from lawmakers, such as Senator Elizabeth Warren’s wealth tax plan and Senator Ron Wyden’s proposal to tax unrealized gains for billionaires. While these proposals are conceptually legal (since Congress has broad taxing powers), they would almost certainly face legal challenges, particularly regarding whether unrealized gains qualify as "income" under the Constitution.

2. Other Countries:

Canada: Unrealized gains are also not currently taxed in Canada, though there has been debate about implementing wealth taxes or other measures that could target unrealized gains.

European Countries: Most European countries also tax realized gains rather than unrealized gains. However, some countries have wealth taxes or other measures that could indirectly tax asset appreciation.

Norway: Norway has a wealth tax that taxes the value of certain assets annually, including unrealized gains. This is an example of a system that indirectly taxes unrealized gains, though it’s structured as a wealth tax rather than a capital gains tax.

3. Wealth Taxes vs. Capital Gains Taxes:

Wealth Taxes: Some countries (e.g., Norway, Switzerland) have wealth taxes that apply to the value of an individual’s assets each year, regardless of whether the gains have been realized. This is not technically the same as a capital gains tax, but it can result in taxing assets that have appreciated in value.

Capital Gains Taxes: Taxing unrealized capital gains directly through the tax code would be a new policy in most jurisdictions, requiring legal changes and potentially facing constitutional challenges in countries like the U.S.

4. Legal Challenges and Future Possibilities:

Constitutional Challenges (U.S.): If the U.S. were to implement a tax on unrealized capital gains, it would likely face legal challenges that could go all the way to the Supreme Court. The key issue would be whether taxing unrealized gains qualifies as taxing "income" under the 16th Amendment or whether it would require a different constitutional justification.

Global Trends: Some countries have started exploring taxes on wealth, but direct taxation of unrealized capital gains remains rare. As wealth inequality and the role of wealth in economic growth continue to be debated, we may see more proposals to tax unrealized gains, though their legality would depend on specific national laws.

Conclusion:

As of now, taxing unrealized capital gains is not widely practiced and would raise significant legal and constitutional issues, especially in the United States. Proposals to tax unrealized gains could be legally challenged, particularly on the grounds that such taxes might not align with the constitutional definition of "income." However, in some countries with wealth taxes or asset-based taxes, there are indirect forms of taxing unrealized gains. The legal landscape could shift if new laws or legal rulings allow for this type of taxation.

#taxes #Harris #KamalaHarris #Economy #CapitalGains #UnrealizedGains #gold #silver #investing

.jpeg)

.jpg)

.jpeg)

.jpg)

.jpg)